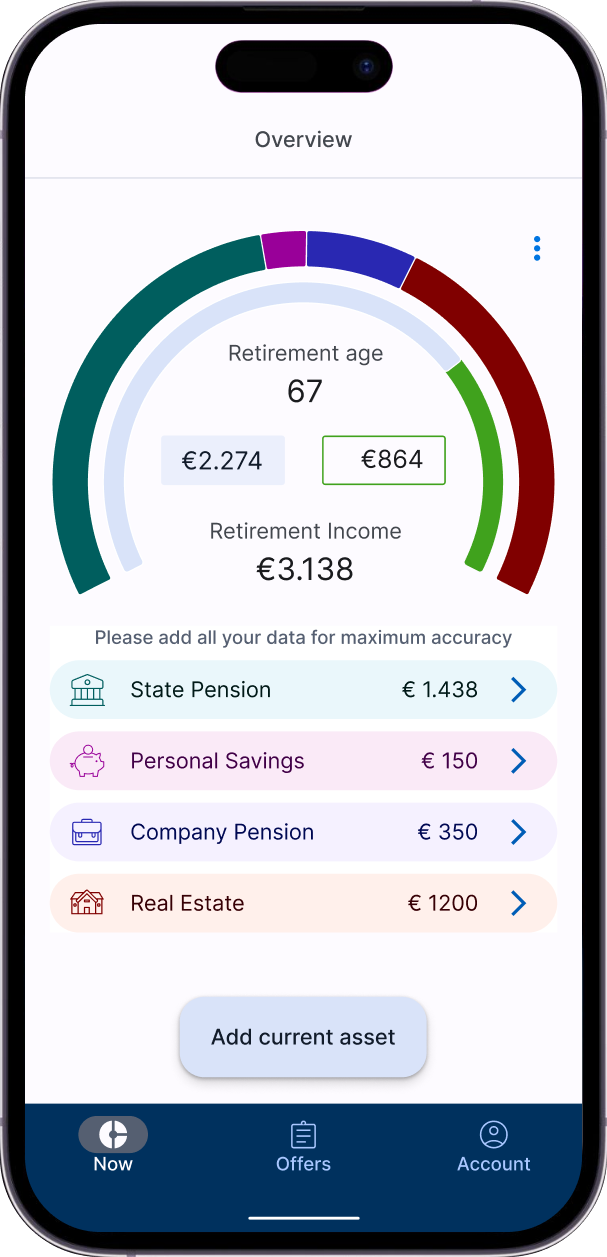

Forecast your future income

Gain a transparent overview

State pension

Real estate

Company pension

Private pension

ETF saving plancoming soon

Personal savings

Financial investments

Precious metals

Stocks

Crypto

Receive an email from us with a download link to open on your mobile phone.

By clicking the button you accept our privacy policy.

Can you imagine

travelling to the future

and fix all the things

you want to change?

Our app makes it as simple as taking an Uber.

Set your desired destination and see all the long-term investments that can take you there.

Fully GDPR compliant

Datacenter in Germany

Based in Berlin

DIN 77230 Financial analysis

Over 160 providers

Easy-to-use simulation tool

Gain a comprehensive view of how your investments today impact your future.

Expert guidance

Whether you're a beginner or an experienced investor, our solution offers a straightforward approach to long-term investing.

Design your future

Find out how far you are from achieving your dream retirement, so you can make informed decisions on how to get there.

State pension

Real estate

Company pension

Private pension

ETF saving plancoming soon

Personal savings

Financial investments

Precious metals

Stocks

Crypto

Add the investments you already have that currently contribute to your long-term savings.

Easily set your financial goals, select your retirement age and design your retirement income.

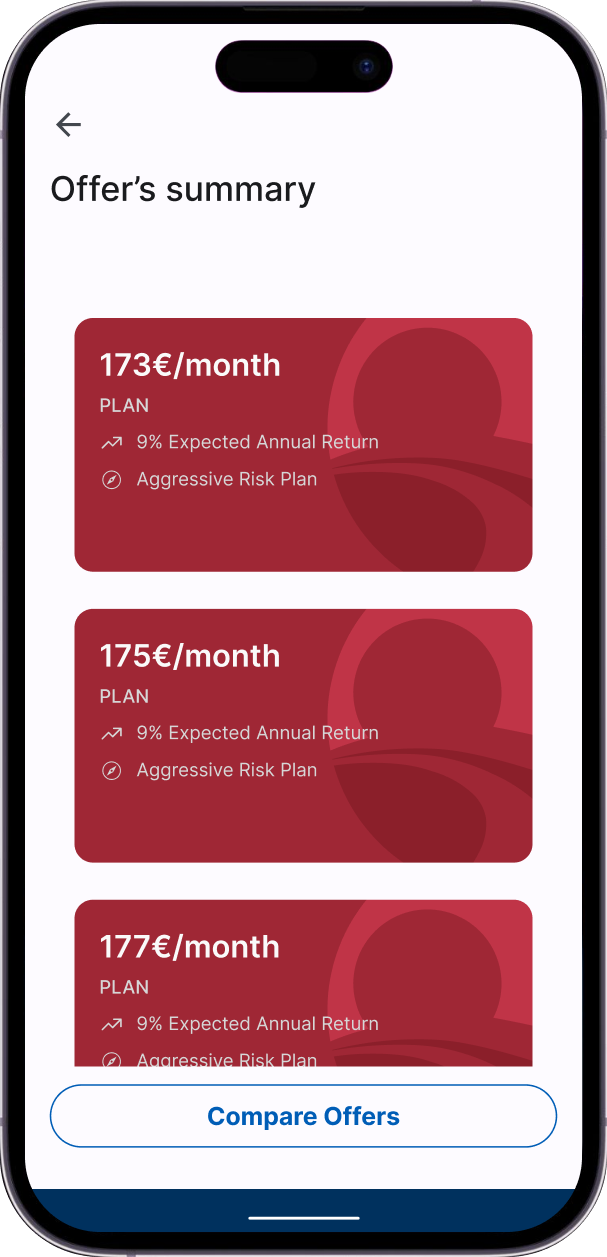

Explore your best-suited options and carry out the practical steps in the app to achieve your set financial goals.

If there is something you are unsure about or need more information, our experts are here to help.

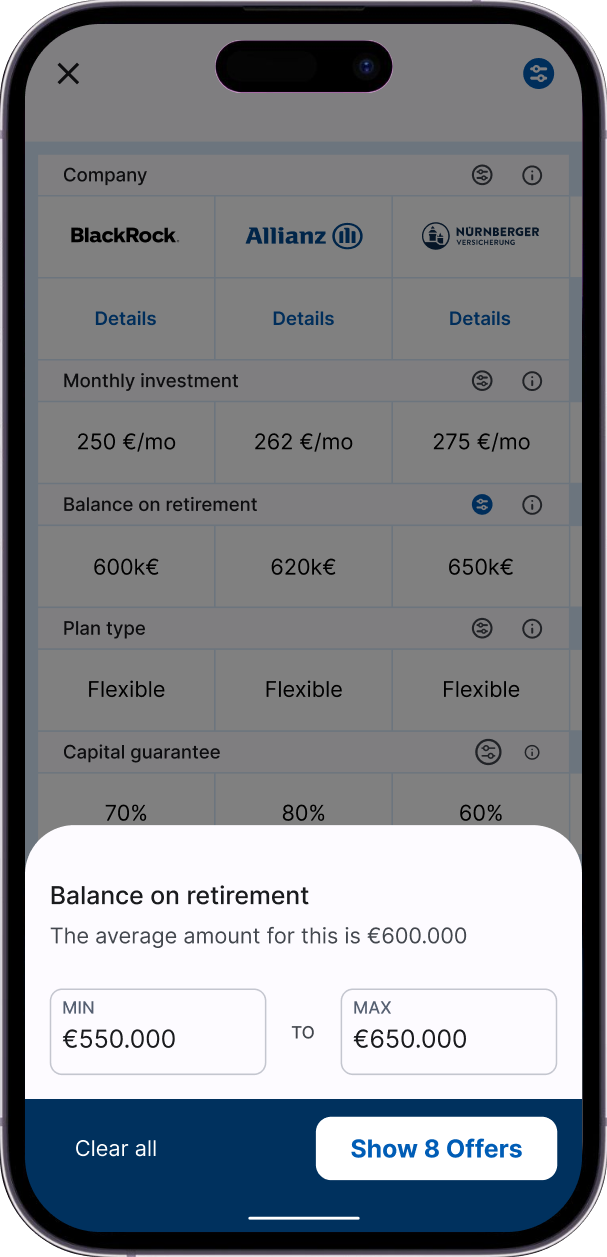

Our experts have in-depth market knowledge and will you help you to understand your most suitable financial options.

You can discuss all various scenarios available to you through consultation with one of our experts.

While our tool provides simulations of how your investments perform, we also offer personalised investment recommendations to help you achieve your financial goals.

We are able to broker many types of investments, whether they are funds, commodities or pension plans.

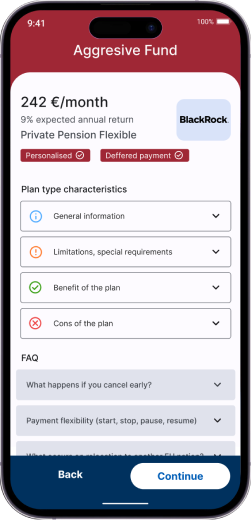

Surface all your possible investment choices with their pros and cons and see what how much it really takes.

We are unaffiliated with any provider and surface all the options available on the market.

Our top priority is keeping your personal data secure. We use multiple securities layers in our systems to keep your information private.

All user-data is stored in Germany in ISO 27001 certified data-centers. Our systems are kept up to date 24/7

You only pay when you accept an offer that meets your standards.

Our technology enables us to broker investment offers 15% cheaper compared to other brokers or comparison portals.

and over 160 other providers