Introduction

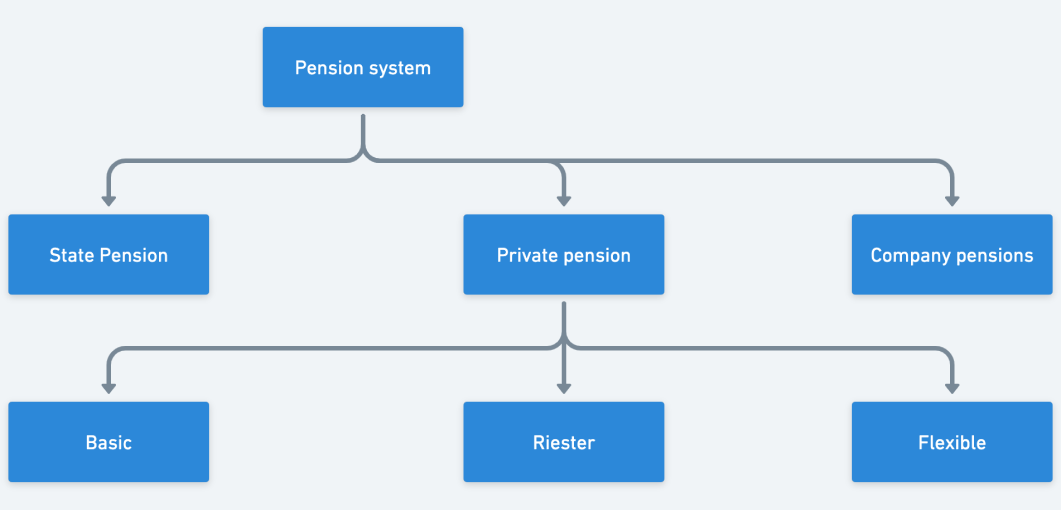

As one of the largest economies in Europe, Germany offers a robust retirement system to its citizens. A crucial part of this system is the Betriebliche Altersvorsorge, or company pension.

A company pension is an employer-sponsored plan designed to provide financial security to employees during their retirement years. Company pensions are promoted by the government using tax advantages and the government also ensures the safety of the investments made through those pensions with regulations.

This guide aims to provide a comprehensive overview of company pensions in Germany, including the different types of plans available, what they are, how they are financed, the history, and the pros and cons, depending on your situation.

An overview of company pensions (bAV) in Germany

What are company pensions (bAV) in Germany?

Company pension, or “betriebliche Altersvorsorge” (bAV) in Germany, refers to a pension plan that is offered by an employer as part of their employee benefits package. The aim of bAV is to provide employees with additional financial security in retirement.

There are several types of bAV plans in Germany, including direct insurance, pension funds, pension schemes, and the “Entgeltumwandlung” plan, which allows employees to contribute a portion of their salary to a pension plan on a tax-advantaged basis.

What is the importance of company pensions (bAV) for employees?

The company pension system is a method by which the government allows both employees and employers to address the shortfalls in retirement income.

Contributions to bAV plans are encouraged by the government by allowing employees to tax deduct their contributions, lowering their taxes and increasing their take-home pay (netto).

The portability of bAV plans means that employees can take their plan with them to new employers.

However, the state pension in Germany is generally not enough to be able to retire comfortably with.

Key benefits for the employee

The basic idea behind occupational pension schemes isn’t to top up insufficient statutory pensions. Rather, the company pension plan allows employees to improve their own retirement provision together with their employer.

In many cases, the company pension plan can be very attractive to employees because it is subsidised. There are many ways to implement it, which we will discuss in more detail in this article.

What makes a company pension plan so attractive?

Contributions are in most cases both tax and social-security-free.

If an employee pays a portion of their salary into a company pension plan, they save taxes and, in many cases, social security contributions as well. Compared to the investment from the net salary, one can invest significantly more.

In addition, if you save on social security contributions, the employer must make a 15% contribution. However, they can only pay this contribution partially or not pay it at all if they don’t have any social security savings.

Many employers pay a subsidy of at least 50%, or pay their employees a lump sum (i.e. €100 per month) regardless of the employee’s contributions.

In summary, it can therefore be said:

The company pension plan makes it possible to invest a higher amount with little personal effort and at the same time still receive subsidies from the employer.

What type of bAV is right for me?

Compare company pension plan providers with our comparison tool.

How are company pensions implemented?

Company pensions can be implemented in several different ways by the employer. However, German law distinctly views a company pension as part of the employee’s compensation. As such, the company is required to guarantee the benefit it provides.

This is why selecting the right “Durchführungsweg” or implentation route, is the most crucial decision for the employer when it comes to the company pension plan.

What is the “Durchführungsweg”?

The “Durchführungsweg” determines how the company pension plan will be established and managed, including who will be responsible for administering the plan, investing the contributions, and paying out benefits.

Direct insurance (Direktversicherung)

The Direktversicherung, or direct insurance, is a popular implementation route (Durchführungsweg) for company pensions in Germany.

Under this model, the employer guarantees the benefit to the employee by transferring their responsibility to a life insurance provider.

The employer takes out a life insurance policy on behalf of the employee, which serves as the pension plan. The employee is the insured person, and the employer pays the insurance premiums. The employee can also contribute to the policy by asking the employer to contribute a part of their gross salary into the plan.

This salary-based contribution lowers the taxable income of the employee and enables the employee to save for retirement from pre-tax income.

When the employee retires, the life insurance policy pays out the pension benefits directly to the employee.

One of the significant advantages of the Direktversicherung model is that it is relatively easy to set up and manage, with the insurance company handling most of the administrative tasks. Additionally, contributions to Direktversicherung policies are tax-deductible for both the employer and employee.

Pensionskasse

The Pensionskasse is another implementation route for company pensions in Germany. It is a type of pension fund established as a separate legal entity from the employer, managed by a board of trustees.

Under this model, both the employer and employee contribute to the pension fund, which is invested to generate returns over time. When the employee retires, they receive a regular pension income based on the accumulated contributions and investment returns. These pension funds are regulated by the Federal Financial Supervisory Authority (BaFin), which ensures that they meet certain solvency requirements and have adequate risk management measures in place.

One of the benefits of the Pensionskasse model is that it offers a high level of security and transparency, with clear rules for governance and investment management. Contributions to Pensionskassen are also tax-deductible for both the employer and employee, making it a tax-efficient option for building retirement savings.

Pensionsfonds

The Pensionsfonds is another popular implementation route for company pensions in Germany. Similar to the Pensionskasse model, it is a type of pension fund established as a separate legal entity from the employer, managed by a board of trustees.

The main difference is that Pensionsfonds are not restricted to a specific industry or employer and can serve multiple employers and employees.

Contributions to Pensionsfonds are invested in a diversified portfolio of assets, such as stocks, bonds, and real estate, to generate returns over time. When the employee retires, they receive a regular pension income based on the accumulated contributions and investment returns.

Pensionsfonds are regulated by the Federal Financial Supervisory Authority (BaFin) and must meet strict solvency and risk management requirements. An advantage of the Pensionsfonds model is that it offers a high level of flexibility and portability, allowing employees to take their pension benefits with them if they change jobs.

Just like with the Pensionskasse, contributions to Pensionsfonds are tax-deductible for both the employer and employee, making it an attractive option as to build savings for your retirement.

Support fund (Untersützungskasse)

The Unterstützungskasse, or support fund, is a type of pension plan established as a separate legal entity from the employer, managed by a board of trustees.

Under this model, the employer makes contributions to the support fund, which is invested to generate returns over time. When the employee retires, they receive a regular pension income based on the accumulated contributions and investment returns.

A draw of the Unterstützungskasse model is that it offers a high degree of flexibility in terms of contribution levels and investment strategies. Additionally, Unterstützungskassen are not subject to the strict solvency and risk management requirements of Pensionskassen and Pensionsfonds, making them a more accessible option for smaller businesses.

However, it is important to note that Unterstützungskassen are not covered by the German Pension Protection Fund, which provides a safety net for pension funds in the event of insolvency.

The employer remains on the hook to fund the employee benefits in case of insolvency but the fund has full flexibility to pursue investment strategies outside of the regulated straightjacket.

Therefore, it is crucial for employers to carefully consider the risks and benefits of the Unterstützungskasse model before selecting it as their preferred implementation route.

Direct commitment (Direktzusage)

The direct commitment is a simple commitment by the employer to pay the employee a salary when they retire.

There are no safeguards and limits in place.

This is typically used for owners or executives, but rarely for employees. Even for executives, the vulnerability remains in that the company has to remain alive and solvent in order to meet its obligations the Direktzusage commitments.

What type of bAV is right for me?

Compare company pension plan providers with our comparison tool.

Comparison of different implementation routes

As we have just touched upon the five different implementation routes for company pensions in Germany, they naturally come with advantages and disadvantages for employers and employees. These are:

Direkversicherung

This is a type of pension insurance that is taken out by the employer for the benefit of the employee. The employer pays the premiums, and the employee receives the pension payments.

The advantages of a Direktversicherung are that it is easy to implement, the employee is protected against insolvency of the employer, and the contributions are tax-deductible.

However, the pension payments are subject to income tax and social security contributions.

Pensionskasse

A Pensionskasse is a legally independent insurance company that manages company pensions. The employer pays the premiums, and the employee receives the pension payments.

The advantages of a Pensionskasse are that it provides additional security for the employee as the Pensionskasse is legally independent, and the contributions are tax-deductible. However, the pension payments are subject to income tax and social security contributions.

Pensionsfonds

A Pensionsfonds is a legally independent fund that invests the contributions of the employer and employee to provide company pensions.

The advantages of a Pensionsfonds are that it offers a higher degree of flexibility in investment strategies, and the contributions are tax-deductible.

However, the pension payments are subject to income tax and social security contributions.

Unterstützungskasse

An Unterstützungskasse is a separate legal entity that is set up by the employer to provide company pensions. The employer pays the contributions, and the employee receives the pension payments.

The advantages of an Unterstützungskasse are that it provides additional security for the employee as the Unterstützungskasse is legally independent, and the contributions are tax-deductible. However, the pension payments are subject to income tax and social security contributions.

Direkzusage

A Direktzusage is a promise made by the employer to pay the employee a pension in the future. The employer bears the financial risk and is responsible for the management of the pension plan.

The advantages of a Direktzusage are that it provides a high degree of flexibility for the employer, and the pension payments are tax-deductible. However, the employee is not protected against insolvency of the employer, and the pension payments are subject to income tax and social security contributions.

What type of bAV is right for me?

Compare company pension plan providers with our comparison tool.

Financing company pensions (bAV)

When it comes to financing company pensions in Germany, there are various options available for employees.

Employee-financed (Arbeitnehmerfinanziert)

In addition to employer-financed company pensions, employees in Germany can also opt for employee-financed, or Arbeitnehmerfinanziert, company pensions. Under this financing method, the employee makes contributions towards their own pension plan, which can be deducted from their gross income before taxes.

Employee-financed company pensions can take different forms, such as the Direktversicherung, the Pensionskasse, and the Pensionsfonds.

As we mentioned earlier, the Direktversicherung involves the employee taking out an insurance policy, with the contributions being paid by the employer. The Pensionskasse is a pension fund set up by the employer, with the employee making contributions. Finally, the Pensionsfonds is a separate fund established by the employer, with the employee making contributions towards it.

Employees who choose to participate in employee-financed company pensions can benefit from tax incentives, such as basic private pension plans, which provide tax benefits for contributions made towards retirement savings.

Mixed financing (Mischfinanzierung)

Another financing option for company pensions in Germany is mixed financing, or Mischfinanziert. This method combines both employer-financed and employee-financed contributions towards the pension plan. Under mixed financing, the employer and employee can agree on the split of contributions towards the pension plan, with the employee having the option to contribute more towards their own retirement savings.

What type of bAV is right for me?

Compare company pension plan providers with our comparison tool.

Comparison of different company pensions financing options

The three main financing models for company pensions in Germany – employer-financed (Arbeitgeberfinanziert), employee-financed (Arbeitnehmerfinanziert), and mixed financing (Mischfinanziert) – each have their own advantages and disadvantages.

Employee-financed (Arbeitsnehmerfinanziert)

Employee-financed company pensions, on the other hand, offer employees more control over their retirement savings and can be a more sustainable financing option in the long-term. However, this financing method may be less attractive to employees as it involves a reduction in their take-home pay (netto).

Mixed financing (Mischfinanzierung)

Mixed financing offers a combination of both employer and employee contributions towards the pension plan, allowing for a more flexible and sustainable option. The employee has the option to contribute more towards their own retirement savings, while the employer still offers a valuable employee benefit. However, this financing method can be more complex to administer and may require more coordination between the employer and employee.

Financing company pensions: Summary

Employer-financed pensions are paid for entirely by the employer, while employee-financed pensions involve the employee making contributions towards their own pension plan. Mixed financing is a combination of both employer and employee contributions towards the pension plan.

Each financing model has its own advantages and disadvantages, and employers and employees should carefully consider their options to choose the one that best meets their needs and goals.

Portability of company pensions

It’s important to consider the portability of company pensions – that is, the ability to transfer accrued pension benefits between different employers or pension providers.

Portability can be a critical factor in ensuring that employees can access and utilise their pension savings effectively, and in making the most of their retirement benefits.

In this section, we’ll explore the topic of portability of company pensions in Germany, including regulations as well as the advantages and disadvantages.

What is portability with regard to company pensions in Germany?

In the context of company pensions in Germany, portability refers to the ability of an employee to transfer their accrued pension benefits from one employer or pension provider to another. This can be an important factor for employees who change jobs frequently or who have non-linear career paths, as it allows them to maintain continuity in their pension savings and avoid losing accrued benefits when they switch employers.

Portability is governed by various legal requirements in Germany, such as the Betriebsrentengesetz (BRSG) or company pension scheme law, which mandate certain rights and obligations for both employers and employees.

For example, the BRSG stipulates that employees who leave a company before they are eligible for pension benefits must be offered the option of preserving their accrued pension entitlements.

The actual process of transferring pensions can vary depending on the type of pension scheme and the rules of the new pension provider. In some cases, the employee may have the option of transferring their accrued benefits directly to the new employer or pension provider, while in other cases, they may need to maintain separate accounts with each provider.

What type of bAV is right for me?

Compare company pension plan providers with our comparison tool.

What are the advantages and disadvantages of portability?

Advantages of portability of company pensions in Germany include:

Advantage 1: Continuity of pension benefits

Employees who switch jobs frequently or have non-linear career paths can maintain continuity in their pension savings by transferring their accrued benefits to a new employer or pension provider.

Advantage 2: More control over retirement planning

Portability gives employees more control over their retirement planning, as they can manage their pension savings across different employers and adjust their contributions as needed.

Advantage 3: Increased competition among pension providers

With portability, employees have the ability to choose the pension provider that best meets their needs, which can help drive competition among providers and lead to more attractive pension products.

Disadvantages of portability of company pensions in Germany include:

Disadvantage 1: Administrative complexity

Transferring pension benefits can be a complex process, and may require coordination between multiple employers or pension providers. This can be time-consuming and may require specialized expertise.

Disadvantage 2: Potential for loss of benefits

Depending on the specific terms of the pension scheme and the transfer process, employees may face the risk of losing some accrued benefits when they switch employers or providers.

Disadvantage 3: Potential for reduced benefits overall

Portability can also result in reduced pension benefits overall, as employees may not contribute as much to their pensions or may lose out on employer contributions or other benefits that are tied to specific employers.

Overall, the advantages and disadvantages of portability of company pensions in Germany will depend on the specific circumstances of each employee and employer, as well as the terms of the pension scheme and the transfer process.

Company pension portability: Pros and cons

Pros

- Continuity of pension benefits

- More control over retirement planning

- Increased competition among pension providers

Cons

- Administrative complexity

- Potential loss of benefits (in some cases)

- Potential for overall reduced benefits

What are the legal requirements for portability of company pensions in Germany?

In Germany, the portability of company pensions is governed by various legal requirements, including:

Legal requirement 1: Betriebsrentengesetz (BRSG)

This is the main legal framework for company pension schemes in Germany. It outlines the rights and obligations of both employers and employees regarding pension benefits, including provisions for portability.

Legal requirement 2: Preservation of pension entitlements

The BRSG requires employers to offer employees who leave the company before they are eligible for pension benefits the option of preserving their accrued pension entitlements. This can be done through various means, such as maintaining separate accounts or transferring the benefits to a new pension provider.

Legal requirement 3: Vesting periods

The BRSG also sets out vesting periods for company pension schemes, which determine when an employee becomes eligible for pension benefits. These periods can vary depending on the specific pension scheme and employer, but must comply with certain minimum standards set out by law.

Legal requirement 4: Information requirements

Employers are required to provide employees with clear and comprehensive information about their pension scheme and the portability options available to them.

Legal requirement 5: Tax regulations

Transfers of pension benefits between different providers or employers may be subject to tax regulations, such as withholding tax or income tax. Employers and employees should be aware of these regulations and factor them into their planning for portability of pensions.

Are you an employee in Germany?

Did you know: Your employer is required to provide you bAV investment options. Learn about your options by speaking to one of our adivsors.

Company pensions – Vesting (Unverfallbarkeit)

What is vesting, or Unverfallbarkeit with regard to company pensions?

In Germany, vesting, or “Unverfallbarkeit,” refers to an employee’s entitlement to certain benefits from a company pension plan even if the employee leaves the company before retirement. Specifically, vesting refers to the point in time at which an employee’s accrued pension benefits become legally protected and cannot be forfeited.

Under German law, employees who participate in a company pension plan typically become vested after a certain period of time, such as five years of service. Once an employee is vested, they have the right to receive certain benefits from the pension plan, such as a guaranteed minimum pension benefit, even if they leave the company before retirement.

Vesting is an important feature of company pension plans because it helps ensure that employees are able to receive some level of retirement benefits even if they do not work for the same employer until retirement. Vesting can also provide employees with greater financial security and peace of mind, knowing that they have earned certain benefits that are protected by law.

What are the legal regulations for vesting for company pensions?

In Germany, there are legal regulations that govern the vesting, or “Unverfallbarkeit,” of employee benefits in company pension plans. Here are some key regulations to keep in mind:

Vesting periods

Employers are required to establish vesting periods for their pension plans, which are typically five years of service. After an employee completes the vesting period, they are entitled to certain benefits from the plan, such as a guaranteed minimum pension benefit.

Guaranteed minimum benefits

Company pension plans are required to provide a guarantee. If the plan doesn’t include any guarantee then the employer is liable to cover the difference between the actual balance at the age of retirement and the invested amount. Most plans offer a capital guarantee of 80%.

Portability of benefits

Employees who leave a company before retirement can either continue the plan privately or ask their new employer to allow them to continue using it as a company pension. In case their new employer refuse to offer the continuation of the old plan the capital of the existing plan can be transferred to the new provider.

Insolvency protection

In the event that an employer becomes insolvent, the German Pension Insurance Association (Deutsche Rentenversicherung) provides protection for employee benefits under company pension plans. Employees are entitled to receive their vested benefits from the pension plan even if the employer is unable to pay.

What are the advantages and disadvantages of vesting?

There are both advantages and disadvantages to the vesting, or “Unverfallbarkeit,” of employee benefits in company pension plans in Germany. Here are some key points to consider:

Advantages

Advantage 1: Employee protection

Vesting ensures that employees have a legal entitlement to certain pension benefits, even if they leave the company before retirement. This provides employees with greater financial security and peace of mind.

Advantage 2: Encourage employee loyalty

By offering vesting in company pension plans, employers can incentivize employees to remain with the company for a longer period of time. This can help reduce turnover and retain valuable talent.

Advantage 3: Portability of benefits

Vesting allows employees to transfer their vested benefits to a new employer’s pension plan, providing them with greater flexibility and control over their retirement savings.

Disadvantages

Disadvantage 1: Cost to employers

Vesting requirements can increase the cost of offering a company pension plan to employees, as employers may need to contribute more to the plan to ensure that employees become vested.

Disadvantage 2: Reduced flexibility for employers

Vesting requirements can also limit an employer’s ability to change or modify their pension plan, as they may need to ensure that employees’ vested benefits are protected.

Disadvantage 3: Uncertainty for employers

While vesting provides certain protections for employees, there can still be uncertainty about the amount and timing of their pension benefits, particularly if they leave the company before retirement. This can make it more difficult for employees to plan for their retirement.

Vesting: Pros and cons

Pros

- Employee protection

- Encourage employee loyalty

- Portability of benefits

Cons

- Cost to employers

- Reduced flexibility for employers

- Uncertainty for employers

Advantages and disadvantages of company pensions for employees

Company pensions offer financial security, but they also have both advantages and disadvantages that employees should consider.

Advantages of company pensions for employees include:

Advantage 1: Tax benefits

Contributions to company pensions are tax-deductible, which means you can reduce your taxable income and pay less tax.

Advantage 2: Employer contributions

Many companies in Germany offer matching contributions to their employees’ pension plans, which can help boost your retirement savings.

Advantage 3: Flexibility

Depending on the type of pension plan, you may have some flexibility in how you contribute and withdraw funds.

Advantage 4: Low fees

Company pensions in Germany often have lower fees than other types of investment products, which can help maximize your retirement savings.

Advantage 5: Portability

If you change jobs, you can usually take your company pension with you or transfer it to another pension plan.

Having listed the above advantages, employees should also consider the disadvantages. They are:

Disadvantage 1: Limited investment options

Company pensions in Germany may have limited investment options compared to other investment products, which could limit your ability to diversify your portfolio.

Disadvantage 2: Locked-in funds

Once you contribute to a company pension plan, the funds are usually locked in until retirement age, which could limit your access to the money in case of an emergency.

Disadvantage 3: Reduced take-home pay (netto)

Contributions to a company pension plan are deducted from your pre-tax income, which means your take-home pay (netto) will be reduced.

Disadvantage 4: Employer dependency

Your employer may have control over your pension plan and its management, which could be a disadvantage if your employer goes bankrupt or changes its pension plan policies.

Disadvantage 5: Lack of portability (in some cases)

Some types of company pension plans may not be portable, which means you may not be able to transfer your pension to another plan if you change jobs.

Company pensions for employees: Pros and cons

Pros

- Tax benefits

- Employer contributions

- Flexibility

- Low fees

- Portability

Cons

- Limited investment options

- Locked-in funds

- Reduced take-home pay (netto)

- Employer dependency

- Lack of portability (in some cases)

Conclusion, summary and future outlook

In conclusion, company pensions are an important aspect of the German social security system, and can offer significant benefits to employees.

By providing a retirement income in addition to the state pension, company pensions can help employees achieve greater financial security in their retirement years.

However, as discussed in this guide, setting up and managing a company pension plan can be complex, and requires careful planning and attention to detail.

What does the future have in store for company pensions in Germany?

The future outlook for company pensions in Germany is generally positive, as the German government has taken steps in recent years to strengthen the country’s pension system and encourage greater participation in company pension plans.

In addition, the government has also implemented reforms to the state pension system, including raising the retirement age and adjusting the calculation of pension benefits, to ensure its long-term sustainability.

However, challenges remain, particularly in the context of an aging population and increasing pressure on public finances.

The COVID-19 pandemic has also highlighted the need for greater resilience in retirement savings and pensions, as workers face increased uncertainty and financial strain.

To address these challenges, it is likely that further reforms and policy measures will be needed to ensure the continued viability and effectiveness of Germany’s pension system, including company pensions.

Nonetheless, the overall outlook for company pensions in Germany is positive, and they are likely to remain an important part of the country’s social security system in the years to come.

Want to get started with company pensions as an employee? Talk to one of our investment advisors to learn about your options.